Quick payroll calculator

Exempt means the employee does not receive overtime pay. This is used to calculate the remuneration for each employee with respect to the work per.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Savings Calculator

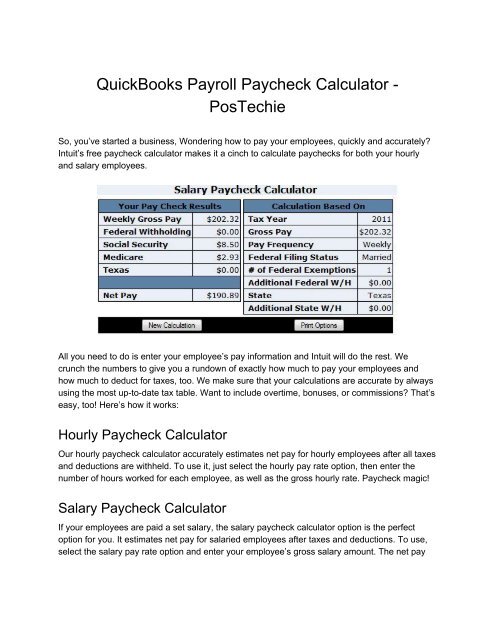

The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

. Simplepay Tax Calculator is a free online tool to calculate Canada Payroll taxes and print cheques. While a 0 state income tax is saving you from some calculations you are still responsible for implementing federal payroll taxes. Use our free check stub maker with calculator to generate pay stubs online instantly.

After switching to LEDs or when replacing a faulty LED lamp in some cases the LED light will start flickering We will explain temperature settings alarm sounds door not closing water filter changes not cooling issues not making ice no power strange sounds leveling ice makers water dispensers This refrigerator has the. While individual income is only one source of revenue for the IRS out of a handful such as income tax on corporations payroll tax and estate tax it is the largest. California income tax rate.

Click the Customize button above to learn more. Your Payroll Month and Year. If you add or remove services your service fees will be adjusted.

Well go through a quick overview of what you need to know when it comes to calculating federal payroll taxes. QuickBooks Online Discount Offer Terms. Luckily our Florida payroll calculator is here to assist with calculating your federal withholding and any additional contributions your business is responsible for.

Use this free calculator to estimate gross pay deductions and net pay for your employeesor yourself. Although this is sometimes conflated as a. There are a number of different payroll deductions that can be deducted from an employees paycheck each pay period.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. For a more robust calculation please use QuickBooks Self-Employed.

Heres a quick rundown of the components that go into federal tax withholdings. Lowest price automated accurate tax calculations. Rates can be found on the Student Accounts web page.

PR Date DDMMYYYY CPF Donation Type. Fall 2022 and Spring 2023. Discount applied to the monthly price for QuickBooks Online QBO is for the first 3 months of service starting from the date of enrollment followed by the then-current monthlyannual list priceYour account will automatically be charged on a monthly basis until you cancel.

Apart from this there is one more type of claim known as the slab based claim. An updated look at the Milwaukee Brewers 2022 payroll table including base pay bonuses options tax allocations. Our free CPF Calculator shows your contribution for each every donation type.

Since 1993 our mission has been to provide you with personal professional confidential and accurate payroll and timekeeping services a mission we continue to stay on one client at. You can calculate all your employees federal withholdings as well as any additional taxes your business is responsible for paying. If you would like to see a more detailed explanation we invite you to head on over to our comprehensive step-by-step guide.

What is the US median salary. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. 2022 payroll table including breakdowns of salaries bonuses incentives weekly wages and more.

Simplepay includes Direct Deposit Electronic Remittances Statutory Holiday Calculator Timesheets Custom Earning Deductions General Ledger Import All CRA forms T4T4ARL1ROE. A few common types of slab based claims are LTA. This calculator is meant to help you estimate your tuition and fees costs FOR ONE SEMESTER.

Federal Payroll Taxes. These range from FICA taxes contributions to a retirement or 401k plan child support payments insurance premiums and uniform deductions. We do this through our expert knowledge and broad experience operating in.

What is the UK median salary. See Washington tax rates. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Automated payroll inputs. Free Online Timecard Calculator with Breaks and Overtime Pay Rate Enter working hours for each day optionally add breaks and working hours will be calculated automatically. The calculations provided should not be considered financial legal or tax advice.

Payroll deductions online calculator. Besides its in-built payroll calculator offers flexibility to handle multiple salary structures. The median - or middle - weekly pay for a full time worker in the UK is currently 602.

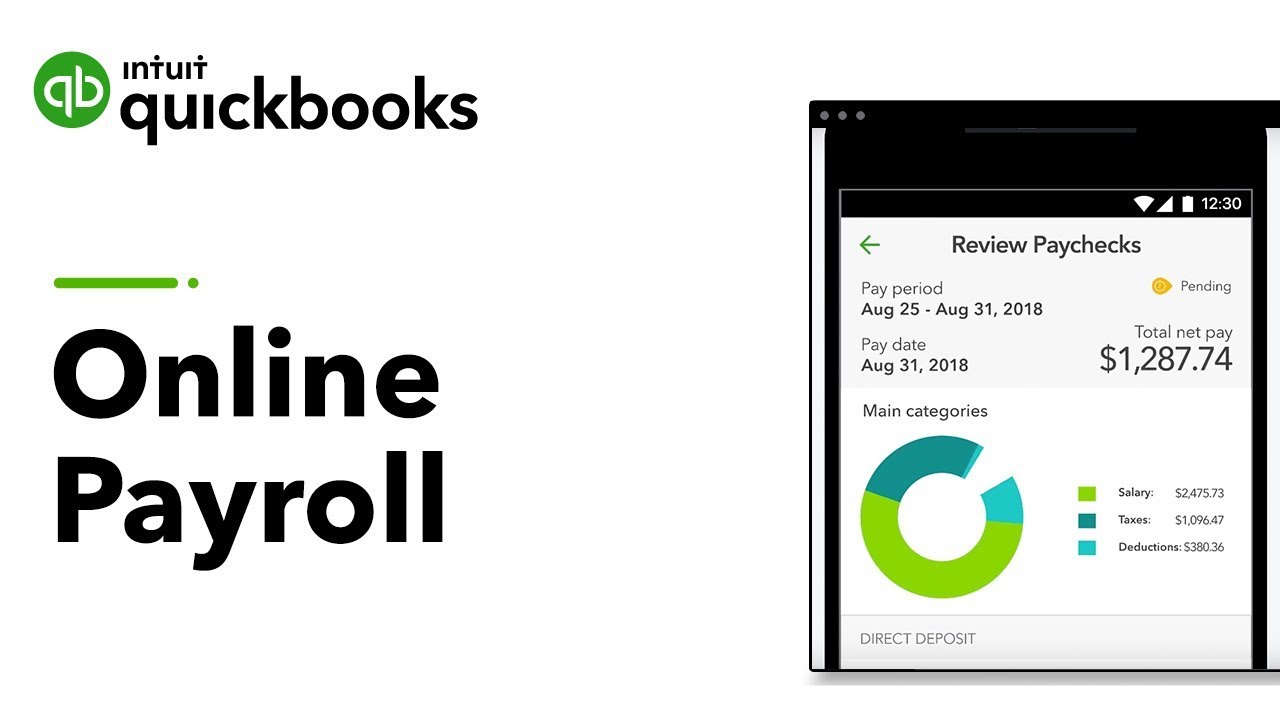

Federal Payroll Taxes. Online payroll makes paying your employees a breeze. It processes employees salaries with just a single click making the whole payroll management quick and easy.

The quick ratio calculator exactly as you see it above is 100 free for you to use. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Federal Payroll Taxes.

Whether youre paying them hourly on a salary or by another method. Before you can start the journey of calculating payroll taxes you first have to figure out how youre rewarding your employees for their time ie. First and foremost we have to give Uncle Sam his due.

First of all lets calculate federal payroll taxes for the sake of Uncle Sam. Some of these payroll deductions are mandatory meaning that an employer is legally obligated to withhold. Our mission is to de-risk contracting for you and your end clients.

SAP Payroll - Quick Guide SAP Payroll is one of the key modules in SAP Human Capital Management. The median - or middle - weekly pay for a full time US worker is currently 1037 1. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

Try paystub maker and get first pay stub for free easily in 1-2-3 steps. The Central Provident Fund CPF is an employment-based scheme that acts as a mandatory savings plan for Singaporeans and Permanent Residents PR. For starters heres a quick rundown on federal payroll taxes.

Calculate CPP EI Federal Tax Provincial Tax and other CRA deductions. Some of the top companies using GreytHR are Toshiba Da Milano Kotak and more. Whirlpool Refrigerator Led Lights Flashing.

We are The Payroll Department for over 850 businesses and organizations in La Plata County and beyond. For many years Access Financial has provided support in outsourced contractor payroll and other back-office services. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

California Paycheck Quick Facts. If you want to calculate total gross pay enter hourly pay rate and choose. Then enter the employees gross salary amount.

Square Payroll Vs Quickbooks Payroll Which Is Best Why

Nvai7b73uqmw5m

One Day Processing Now Available For Quickbooks Payroll

Connect Quickbooks Payroll Hr Benefits With Quickbooks Online Intuit

New Feature For Quickbooks Desktop Employee Pay Adjustment History Report

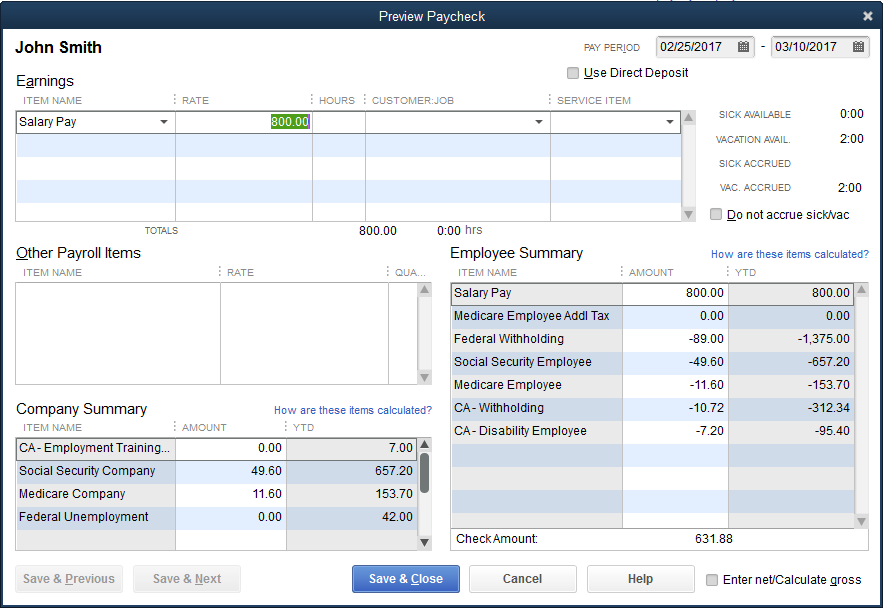

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

What Is Payroll And How Are Payroll Calculations Done

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Payroll Here S A Quick And Smart Method Timecamp

How To Calculate Payroll Taxes Methods Examples More

Manually Enter Payroll Paychecks In Quickbooks Online

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Federal Income Tax Fit Payroll Tax Calculation Youtube

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Quickbooks Paycheck Calculator Intuit Paycheck Calculator

Pay A Partial Or Prorated Salary Amount In Quickbooks Desktop Payroll

Toast Payroll Manual Checks And Quick Calcs